Sales for the year came in at $29.29 billion, compared to $31.86 billion in 2021.

Apple's tablet continues to show low growth, as sales continue to decline. The Boston Matrix is a more informal marketing tool used for product portfolio analysis and management, developed by the Boston Consulting Group in the early.

It was developed in 1970 by the Boston Consulting Group. Analysts use the BCG Growth Share Matrix in order to analyze how well or poorly a company or corporation is using its resources for itself, its subsidiaries, and/or its products.

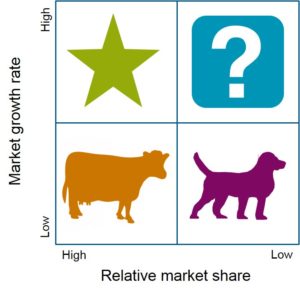

Finally, a company with a high growth rate and a large market share is called a star these are expensive to operate, but produce large profits. A company with a high growth rate and a small market share is called a problem child or question market it is expensive to operate and produces little or no profit, but has the potential to do so. A company with a low growth rate and a small market share is a dog it generally produces a small profit and is usually sold. A company with a low growth rate and a large market share is called a cash cow it requires little capital to maintain operations and produces a solid profit. The growth share matrix, created in 1968 by BCGs founder Bruce Henderson, is a framework that helps companies decide how to prioritize their different. The chart plots market share (on the x-axis) against growth rate (on the y-axis). A chart with four quadrants that helps businesses analyze themselves by placing themselves (or their subsidiaries or products) into one of the four quadrants.

0 kommentar(er)

0 kommentar(er)